By Lila Brown | California Black Media

On February 21, President Joe Biden announced the cancellation of $1.2 billion in student debt for almost 153,000 borrowers enrolled in the Saving on a Valuable Education (SAVE) repayment plan.

Biden shared the news during a campaign stop while on a tour of California. From Feb. 20 to February 22, the President visited Los Angeles, San Francisco, and Los Altos Hills.

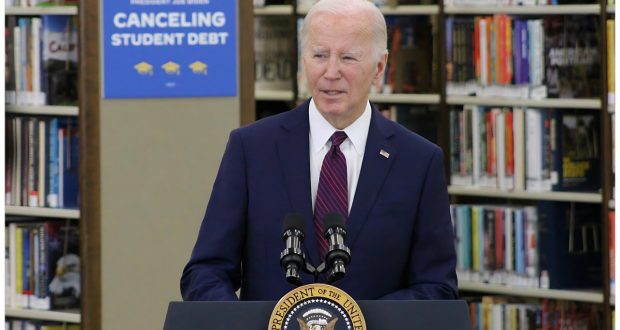

“There were existing programs in the law for fixing and adjusting the programs. We had to change them to make people eligible. And that’s what I’ve done,” Biden said, speaking at the Julian Dixon Library in Culver City.

After the President referenced the Supreme Court’s decision to strike down his administration’s original debt relief plan, Biden summed up some of the benefits of his executive action.

“It helps everyone, not just the people whose debt is relieved, but when people in student debt are relieved, they buy homes, they start businesses, they contribute, they engage in the community in ways they weren’t able to before. It actually grows the economy,” he said.

The Biden-Harris Administration first introduced the SAVE plan with the belief that education beyond high school should unlock doors to opportunity, not burden borrowers with unmanageable debt.

Biden expressed gratitude for being able to make progress as he promised to borrowers and thanked Culver City Mayor Yasmine Imani-McMorrin for her support in helping to roll out the plan.

So far, the Biden-Harris Administration has approved nearly $138 billion in student debt cancellation for almost 3.9 million borrowers through more than two dozen executive actions. The borrowers receiving relief are the first to benefit from a SAVE plan policy that provides debt forgiveness to borrowers who have been in repayment after as little as 10 years and took out $12,000 or less in student loans.

According to data from the National Center for Education Statistics, students, particularly those from less-advantaged backgrounds, have had to rely on substantial student loans to finance their education. Similarly, college graduates who are the first in their family to go to college are more likely to incur debt to complete their degree than their peers. Over the past 40 years, college tuition has significantly outpaced many families’ incomes.

Early in his administration, Biden pledged to reform the student loan system and make sure higher education would be a pathway to the middle class.

“This is what the American dream is all about, and this is exactly what the President is advocating for. When people are financially insecure, they are unable to feel when the economy is good. Our economy is stronger than ever, but that is hard to notice when you’re in the quicksand of student loan debt,” said Congressmember Sydney Kamlager-Dove (D-CA-37), who spoke at the press conference.

Other elected officials attending the news briefing included Sen. Alex Padilla (D-Calif.), Los Angeles Mayor Karen Bass, Mayor McMorrin, Los Angeles County Supervisor Holly J. Mitchell, Los Angeles County Supervisor Lindsey Horvath.

“Black college graduates have, on average, $25,000 more in student debt than white college graduates,” Kamlager-Dove added. “This is evidence of something we all already knew: that the cost of success is higher if you’re Black.?Combating this disparity?must?be part of the conversations we have around student debt, just like it is around wealth creation. And President Biden gets it.”

The Biden-Harris Administration introduced the Saving on a Valuable Education (SAVE) plan in August 2023. This new income-driven repayment (IDR) plan, like its predecessor, is voluntary and bases monthly student loan payments on the borrower’s earnings. However, the new formula includes adjustments such as (but not limited to) shielding more income from being used to calculate student loan payments and waiving unpaid interest at the end of each month to lower monthly payments.

As the full SAVE regulations go into effect on July 1, 2024, the Department of Education has implemented three key benefits starting with the amount of income protected from payments on the SAVE plan which has risen to 225% of the Federal poverty guidelines (FPL). Next, the Department has stopped charging any monthly interest not covered by the borrower’s payment; and finally, married borrowers who file their taxes separately are no longer required to include their spouse’s income in their payment calculation for SAVE.

“Addressing student loan debt should be thought of as a job’s initiative, said Bass, who hosted Biden at CJ’s Cafe in Baldwin Hills before the announcement.

“This should be thought of as a housing initiative. This should be thought of as an economic motivator for young people throughout the country,” Bass continued. “Student loan debt cripples our workforce – especially when it comes to addressing homelessness. We need more social workers, more mental health specialists, and more service providers.”

During his remarks, President Biden thanked Mayor Bass for her partnership and friendship.

While introducing the President, Dr. Jessica Saint Paul, a Physician Assistant, and public health practitioner spoke about the importance of receiving student debt relief. She said her loans ballooned from $90,000 to $145,000 even though she was making monthly payments.

Dr. Saint Paul, a Haitian immigrant, said the inability to repay back loans delayed her plans to start a family but after her debt had been forgiven, she was able to follow through on her dreams. Now, the proud mother to a baby daughter, she currently works as an adjunct professor at the Los Angeles Community College District.

“I’m proud to have been able to give borrowers like so many of you the relief you earned. I’m never going to stop fighting for hardworking American families. If you qualify, you’ll be hearing from me shortly,” the President concluded. “It’s about your dignity. It’s about opportunity.”

Westside Story Newspaper – Online The News of The Empire – Sharing the Quest for Excellence

Westside Story Newspaper – Online The News of The Empire – Sharing the Quest for Excellence