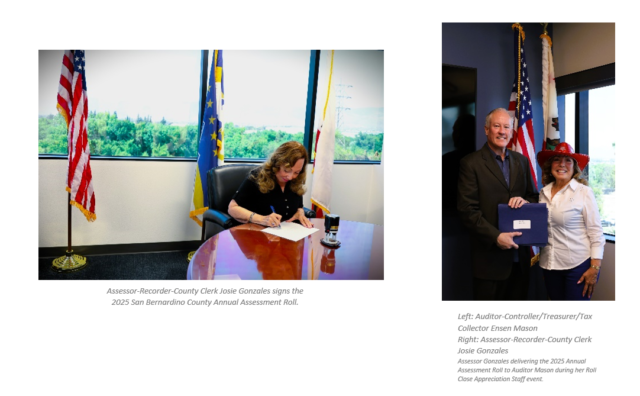

SAN BERNARDINO, CA– The 2025 San Bernardino County Assessment Roll, containing 903,602 parcels valued at $361,173,815,517, has been signed by Assessor-Recorder-County Clerk Josie Gonzales and personally delivered to Ensen Mason, San Bernardino County’s Auditor-Controller/Treasurer/Tax Collector.

“San Bernardino County continues to thrive with remarkable growth,” said Assessor-Recorder-County Clerk Josie Gonzales. “Our team is dedicated to ensuring that homeowners are well-informed about the various ways they can save on property taxes. This year, we have successfully assisted 11% more disabled veterans as compared to last year, resulting in $10.9 million in property tax savings.”

The assessment roll reflects the total gross assessed value of locally assessed real, business, and personal property in San Bernardino County as of the previous lien date of January 1. State law requires county assessors to discover all assessable property, inventory and list all taxable property, value the property, and apply all legal exemptions/exclusions on the annual local assessment roll.

2025 San Bernardino County Assessment Roll Highlights:

- Total assessed value: $361,173,815,517 billion

- Homeowner’s Exemption: 222,094 homeowners qualified, resulting in over $15.5 million in property tax savings

- Disabled Veteran’s Exemption: 6,596 disabled veterans qualified, receiving over $10.9 million in property tax savings

- Welfare institutions: 4,892 institutions (schools, churches, museums, and non-profits) received over $108 million in property tax savings

- Prop 8s: The Assessor’s office proactively identified Prop 8 value reductions, ensuring fair assessments and potential tax savings for qualified property owners

City Highlights:

- City of Ontario: Highest assessed value at $46 billion

- Rancho Cucamonga: Second highest assessed value at $38 billion

- Fontana: Third highest assessed value at $35 billion

- Grand Terrace: Exponential increase due to the development of the Condor Energy Storage Project

Growth:

- City of Ontario: Largest assessment value increase, adding $3.7 billion from 2024, an 8.6% increase

- Incorporated cities: Total value of $307 billion, a 6.3% increase

- Unincorporated areas: Total value of $53 billion, a 4.4% increase

In compliance with state regulations, the assessor must enroll real property at the lower value of its current market value or the Proposition 13 value—the market value from the date the property was purchased or built, adjusted by a maximum of 2% each year. “I encourage all property owners to visit our website to explore potential property tax-saving opportunities,” said Assessor-Recorder-County Clerk Gonzales. Visit arc.sbcounty.gov/property-tax-savings to learn more about tax saving programs such as the Homeowners’ or Disabled Veteran’s Exemption.

Assessed valuations should not be used as forecasts or be deemed as predictions of future property valuations. Individuals wishing to see their personal assessed values may visit the Assessor’s website at: arc.sbcounty.gov. For assistance, you are encouraged to contact the Assessor’s toll-free number at 1-877-885-7654.